Part 4: STEEPLE Analysis of The Kellanova Acquisition and Conclusion

- Tamerlan Salzhanov

- Nov 30, 2025

- 3 min read

In this part, we will analyse the case through STEEPLE analysis. STEEPLE analysis is a strategic planning tool designed to help organizations evaluate the various external factors influencing their business operations. It provides an objective framework to evaluate how the acquisition influences Mars Inc. by examining the Social, Technological, Economic, Environmental, Political, Legal, and Ethical factors of the merger.

Social Factors

Changes in consumers' behaviour, with the increased prevalence of online purchasing after COVID, directly enhances the strategic rationale behind the acquisition. Kellanova’s digital-first approach for brands like Pringles is shown in much higher e-commerce performance; the combined value sales in snacks e-commerce for Mars and Kellanova in 2023 were 55% higher than Mars’ value sales of snacks in e-commerce alone.

Technological Factors

Kellanova brings advanced digital capabilities to Mars via its strong direct-to-consumer (DTC) infrastructure and e-commerce systems. This advances Mars’ technological capabilities in the increasingly digital snack marketplace.

Economic Factors

Mars’ indulgent portfolio will complement Kellanova’s savoury brands (e.g., Pringles, Cheez-It), providing economic synergy, and boost global brand recall.

However, the acquisition needed roughly $55 billion in financing, $26 billion through debt and a $29 billion bridge loan. The credit ratings group S&P had already raised concern regarding that level of leverage, especially if antitrust complications associated with the acquisition led to delays or impacted completion of the deal. Moreover, Kellanova's reliance on raw materials (corn, wheat, sugar) leads to Mars incurring significant commodity price volatility, which could sharply increase production costs.

Environmental Factors

Kellanova’s industry-recognised ESG commitments, particularly through its Better Days™ Promise, aligns both companies to global sustainability expectations. This is increasingly important in an industry where snacks are under scrutiny concerning packaging waste, carbon emissions, and agricultural sourcing. Kellanova’s existing ESG programmes and commitments helps Mars in an era where consumers, especially millennials, give importance to brands practicing social responsibility.

Political Factors

The acquisition enhances Mars politically, both through greater multinational footprint and reduction in over-reliance on specific regions. Mars is strong in China; Kellanova is stronger in other places. The combined portfolio offers broader diversification of geopolitical risk.

Legal Factors

The European Commission has opened a Phase 2 antitrust investigation speculating that the combined company may create a monopoly within the industry. Several European supermarkets have objected based on potential monopoly concerns, which is causing political pressure across regulators. As with any merger predisposed to antitrust action, there is the potential for forced divestitures of some of Mars’ or Kellanova’s holdings, which would reduce strategic value and lengthen the timeframe for integration.

Ethical Factors

Ethically, there are concerns regarding potential price inflation within an already expensive snack category. Industry expert, Erol Schweizer, has warned about "oligopoly-style pricing," which can compromise brand trust and customer loyalty.

Overall, this study aimed to address the question of how will the acquisition of Kellanova by Mars Inc influence its strategic position in the global food industry? Through this research both qualitative and quantitative tools were used through both external and internal sources. On the quantitative side, while the profitability ratios showed a downward trend lately, they were satisfactory. However, it was found that Kellanova is highly geared.

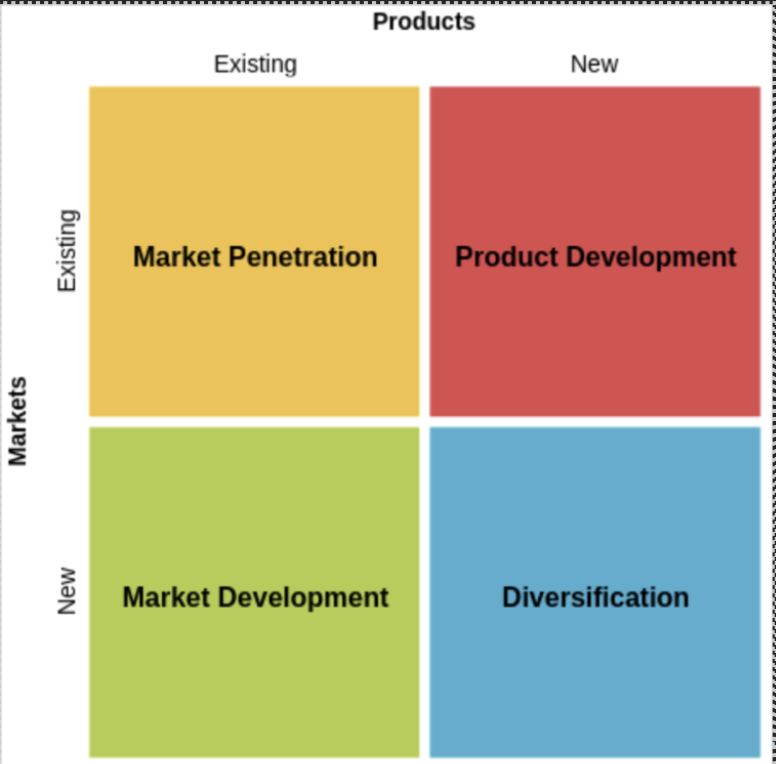

Qualitatively, through Ansoff’s Matrix it was observed that the acquisition of Kellanova enabled all 4 of the growth strategies to happen and this is positive for the acquisition. The STEEPLE analysis revealed that the acquisition contains substantive advantages in nearly all social, technological, environmental and geographic factors, particularly as it relates to digital capability, ESG alignment, and access to a improved globalisation. The most significant issues arose from antitrust regulations and debt exposure.

Finally, based upon the strength of the identified synergies and the evident strategic long-term advantages, together as 4 contributors to these series of articles, we conclude that Kellanova will positively contribute to Mars Inc., if the firm properly manages the legal and financial variables that accompany the deal. Some limitations of this commentary are that the conclusion depends heavily on how legal and regulatory bodies will react, which is highly uncertain. The commentary also relies entirely on secondary sources because it is not feasible to interview Mars executives.

Comments